Table of Contents

- What does ROAS mean?

- ROAS Vanity Metrics

- Calculate and Express ROAS

- What is a Good ROAS?

- The Break-Even ROAS Formula

- The Dark Side of ROAS

- ROAS in the Real-World Context

- Difference Between ROAS and ROI?

- ROAS Optimization Hacks

- ROAS Killer Checklist

- The Final Word

- Frequently Asked Questions

Let’s start with a story you’ve probably lived. You are at a carnival, and a barker tries to sell you $10 tickets to play a game. You need to hit three targets to win a giant teddy bear. You pay, take your shot, and miss. Now imagine this happens every day. You keep handing over $10, but you never know if you’ll walk away with the prize or empty-handed. That’s why running ads without understanding ROAS feels like a guessing game where you’re burning cash and hoping for magic.

Return on Ad Spend (ROAS) is the antidote to that chaos. It’s not just a metric; it’s your bullsh*t detector for marketing. This guide will unpack ROAS in plain language, show you why it’s the backbone of profitable advertising, and teach you how to use it like a pro, even if you’re allergic to spreadsheets.

Know more: Digital Advertisement

What Does ROAS Mean?

Return on Ad Spend (ROAS) measures how much money you make for every dollar you pour into ads. It’s the ultimate “Was this worth it?” gauge.

Here’s the formula: ROAS = Revenue from Ads / Cost of Ads

If you spend $1,000 on Facebook ads and generate $5,000 in sales, your ROAS is 5:1 (or 500%). Simple, right? But beneath that simplicity lies a superpower: ROAS tells you exactly which ads are pulling their weight and which are dead weight.

Why ROAS Beats Vanity Metrics Like a Drum?

Marketers used to obsess over “likes,” “clicks,” and “impressions.” But let’s be real, what good are 10,000 clicks if none of them buy? ROAS cuts through the noise. It answers the only question that matters: “Did my ads make money, or did they just make my ego feel good?”

Think of it in the following ways.

- Clicks: People glanced at my billboard.

- ROAS: People saw the billboard, drove to my store, and bought $500 worth of sneakers.

How to Calculate and Express Return on Ad Spend (ROAS)

Return on Ad Spend (ROAS) is a key metric that helps traders, brokers, and financial platforms measure the profitability of their ad campaigns. In simple terms, ROAS shows how much revenue your advertising generates compared to what you spend.

The formula is straightforward:

ROAS = Revenue Generated from Ads ÷ Advertising Cost

Example in Trading

Imagine you run a digital campaign for your trading platform and spend $2,000 on ads. Those ads bring in new traders whose deposits and fees generate $8,000 in revenue.

Using the formula:

ROAS = 8,000 ÷ 2,000 = 4

This means your ROAS is 4, or put another way, you earned $4 for every $1 spent.

Different Ways to Express ROAS

- As a Ratio:

The most common way is to write it as a ratio, e.g., 4:1. This tells you that for every $1 spent, $4 came back in revenue. - As a Percentage:

If you prefer percentages, multiply the result by 100. In the above trading example:

4 × 100 = 400% ROAS.

Both expressions work, so choose the one that fits your reporting style.

What Counts as “Advertising Cost”?

Calculating ROAS isn’t always as simple as just looking at ad spend. You need to decide what costs to include in your calculation. Here are some considerations:

- Platform Spend: The direct amount you paid for running ads (e.g., Google Ads, Meta Ads, trading forums, or banner placements).

- Vendor or Affiliate Fees: If you work with partners, affiliates, or media buyers, their commissions should be factored in.

- Team & Management Costs: Whether you have an in-house marketing team or work with an agency, salaries or management fees also count.

Some trading companies prefer to calculate ROAS only on raw ad spend for clarity, then create a separate, more comprehensive ROAS that includes all related costs. This approach gives you two insights:

- A clean view of how the ads themselves are performing.

- A broader understanding of the campaign’s true profitability after every dollar spent is considered.

What is a Good ROAS?

This is where marketers start sweating. There’s no universal good ROAS. It depends on your margins, industry, and goals.

- E-commerce: 4:1 is often the baseline. Make $4 for every $1 spent.

- High-margin luxury goods: 2:1 might be profitable.

- Low-margin services: You might need 10:1 to stay afloat.

The Break-Even ROAS Formula

To find your magic number, use this formula.

Break-Even ROAS = 1 / Profit Margin

For example, if your profit margin is 25% after product costs, shipping, etc., your break-even ROAS is 4:1. Anything above that is profit; below it, you’re losing money.

The Dark Side of ROAS

Return on Ad Spend (ROAS) isn’t perfect. It ignores long-term value like repeat customers and costs beyond ads like overhead costs. A customer acquired through a 2:1 ROAS campaign might be worth 10x more over their lifetime, but ROAS alone won’t tell you that.

ROAS in the Real-World Context

Case Study 1: How a D2C Skincare Brand Turned a 1:1 ROAS into 7:1

A startup spent $50k/month on Instagram ads selling $100 serums. The initial ROAS of them was 1:1. They fixed it in the following ways.

- Audit the Audience: They were targeting skincare enthusiasts earlier and now they switched to a smaller category like “people who bought luxury beauty products in the last 30 days.”

- Kill the Weak Links: Dropped underperforming ad creatives.

- Upsell Post-Purchase: Added a post-checkout offer for a $30 toner.

The net result is, their ROAS jumped to 7:1 within 3 months.

Case Study 2: The ROAS Trap That Bankrupted a Food Delivery App

A meal-kit company celebrated a 5:1 ROAS until they realized the following.

- Their ads attracted one-time bargain hunters and so they had an 80% churn rate.

- Their CAC or Customer Acquisition Cost was $50, but their lifetime value was $40.

Moral of the story: ROAS alone can’t save you from a flawed business model.

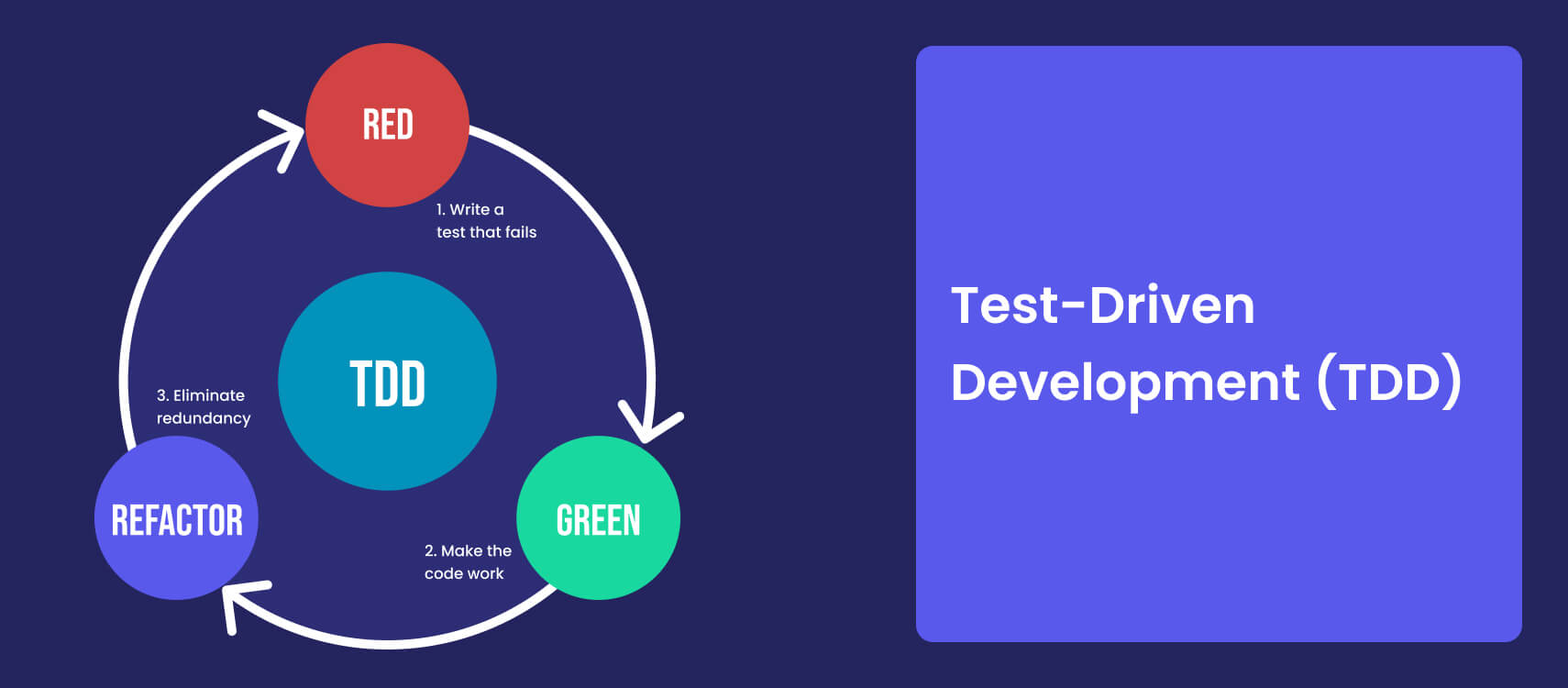

What Is the Difference Between ROAS and Roi?

The financial metrics ROAS (Return on Ad Spend) and ROI (Return on Investment) differ in their measurement scope and their financial evaluation purposes. The two financial metrics serve different purposes because they measure different aspects campaigns against their total advertising costs. The ROAS calculation shows how much revenue comes from each dollar spent of business performance.

The Return on Ad Spend (ROAS) metric calculates the revenue produced by advertising on advertising. ROAS operates with a limited focus because it measures only the direct revenue generated by advertising expenses. A business that spends $5,000 on Google Ads generates $20,000 in sales from those ads which results in a ROAS ratio of 4:1 or 400%. The metric provides advertisers with specific performance data to determine whether they should expand their campaigns or make adjustments or stop running them.

ROI represents a wider measurement than ROAS because it evaluates the complete profitability of investments through revenue analysis and all related expenses. The ROI calculation determines the complete financial return from investments by subtracting all expenses from revenue. The ROI calculation determines the complete financial return from investments by subtracting all expenses from revenue. The $20,000 revenue from the previous example would require additional costs for staff salaries and software tools and vendor fees and fulfillment expenses and customer service expenses. The ROI calculation results in 100% because the $10,000 net profit equals the $10,000 total investment amount.

ROAS functions as an advertising-specific top-line efficiency metric, yet ROI serves as a bottom-line profitability indicator for evaluating business activities. The combination of advertising revenue and business operating expenses determines the overall profitability of a company. A company can achieve positive ROI from its general business operations yet experience poor ROAS from its advertising campaigns, which require optimization.

ROAS Hacks: How to Optimize Like a Wall Street Trader?

To optimize ROAS, some of the key strategies that you can implement include the following.

Barbell Strategy for Budgets

- Put 70% of your budget into proven, high-ROAS campaigns.

- Use 30% to test wild ideas.

ROAS ≠ ROI: Avoid the Margin Murderer

Return on Ad Spend (ROAS) ignores product costs. Let’s say you are selling $50 watches. Ad cost is $10/click and the conversion rate is 2%. So, a $500 ad spend for 10 clicks amounts to 0.2 sales. What is missing here is the profit per sale. One always needs to factor in profit per sale, not just revenue.

The Attribution Differences

Facebook says your ROAS is 4:1, while Google Analytics says 2:1. Which is true? This happens because attribution models such as last-click, first-click, and linear models distort reality. To fix this, use a blended approach. Track metrics like how many touchpoints customers need before buying or which channels assist sales, even if they don’t close them.

ROAS Killer Checklist: 5 Mistakes That Fail Campaigns

Let’s now provide here a killer Return on Ad Spend checklist mentioning all the mistakes that make campaigns fail.

- Ignoring Seasonality: Ignoring seasonal impact is a big mistake. For example, a Christmas decor brand boosted ad spend in July, confused as to why Return on Ad Spend plummeted.

- Targeting Broad audiences: This often results in wasted spending. Instead, use lookalike audiences or retarget cart abandoners.

- Forgetting mobile users: Since mobile users constitute a chunk, ignoring or forgetting them can be costly. For example, a luxury watch brand’s ads are linked to a desktop-optimized site. For mobile users, 70% of traffic bounced resulting in 0.8:1 ROAS.

- Over-Optimizing for ROAS: If you give all your focus to ROAS, you can lose customers from other streams. For example, a brand paused all ads under 4:1 Return on Ad Spend and killed 60% of their high-LTV customers.

- Using Stock Photos That Look Straight from Ads: Such photos that smell Ads pull down ROAS. Real-life A/B test result tells us that Ads with authentic user photos had 3x higher Return on Ad Spend than polished studio shots.

The Final Word

Return on Ad Spend (ROAS) is your compass, but not your destination. Use it only to gut-check campaigns, reveal hidden profit leaks, and make a watertight case to increase your budget. But remember: A 10:1 ROAS means nothing if your product sucks, your team hates you, or your customers feel duped. Pair ROAS with empathy, creativity, and a willingness to fail and you’ll do more than hit targets. You’ll build a brand people love.

To progress from here calculate your current ROAS, find one campaign underperforming your break-even point, and start A/B testing one change after another such as a new audience, better offer, or different creative.