Finovia Set Out to Simplify Finances With Smarter Automation and Real-time Transactions

Finovia is a feature-rich finance management mobile app developed by EncodeDots to streamline personal budgeting and financial planning. This case study highlights how EncodeDots combined user-centric design and smart automation to create a unified, stress-free financial experience.

Financial Management

The Challenges

Users were finding the management of their own finances largely frustrating, so EncodeDots strived to do away with these main challenges:

Scattered Data

And between various spreadsheets and budgeting apps and banking applications, users were behind in responses to the times, not exactly ideal for record-keeping and financial transparency.

No Real-time Insights

With no real-time data or visual dashboards, users had a hard time recognizing patterns, realizing where they stood financially, or feeling good about making important decisions.

Manual Tracking

All the expense and income were being recorded by hand, it was time consuming and left margin for errors. This frequently resulted in unreliable and ineffective financial management.

Outdated Experience

Unorganized UIs and difficult navigation that these traditional finance apps in the mad the financial app hard to go through, especially for users who do not have a financial background, and declining users who open the app and drop-out.

The Solutions

To address the problems users encountered, EncodeDots developed a robust finance app that offers:

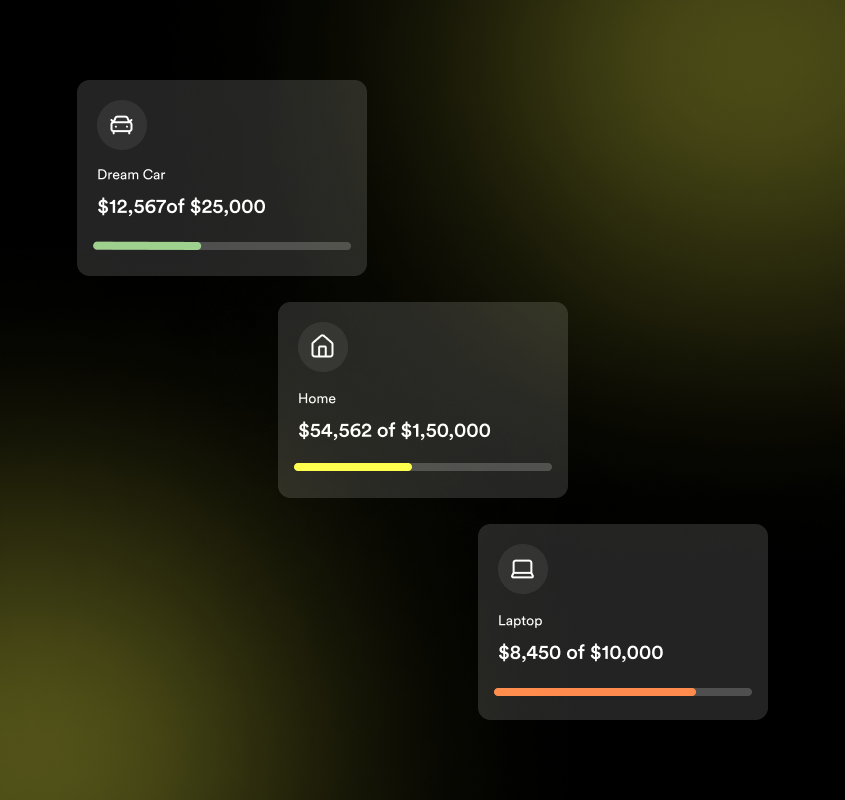

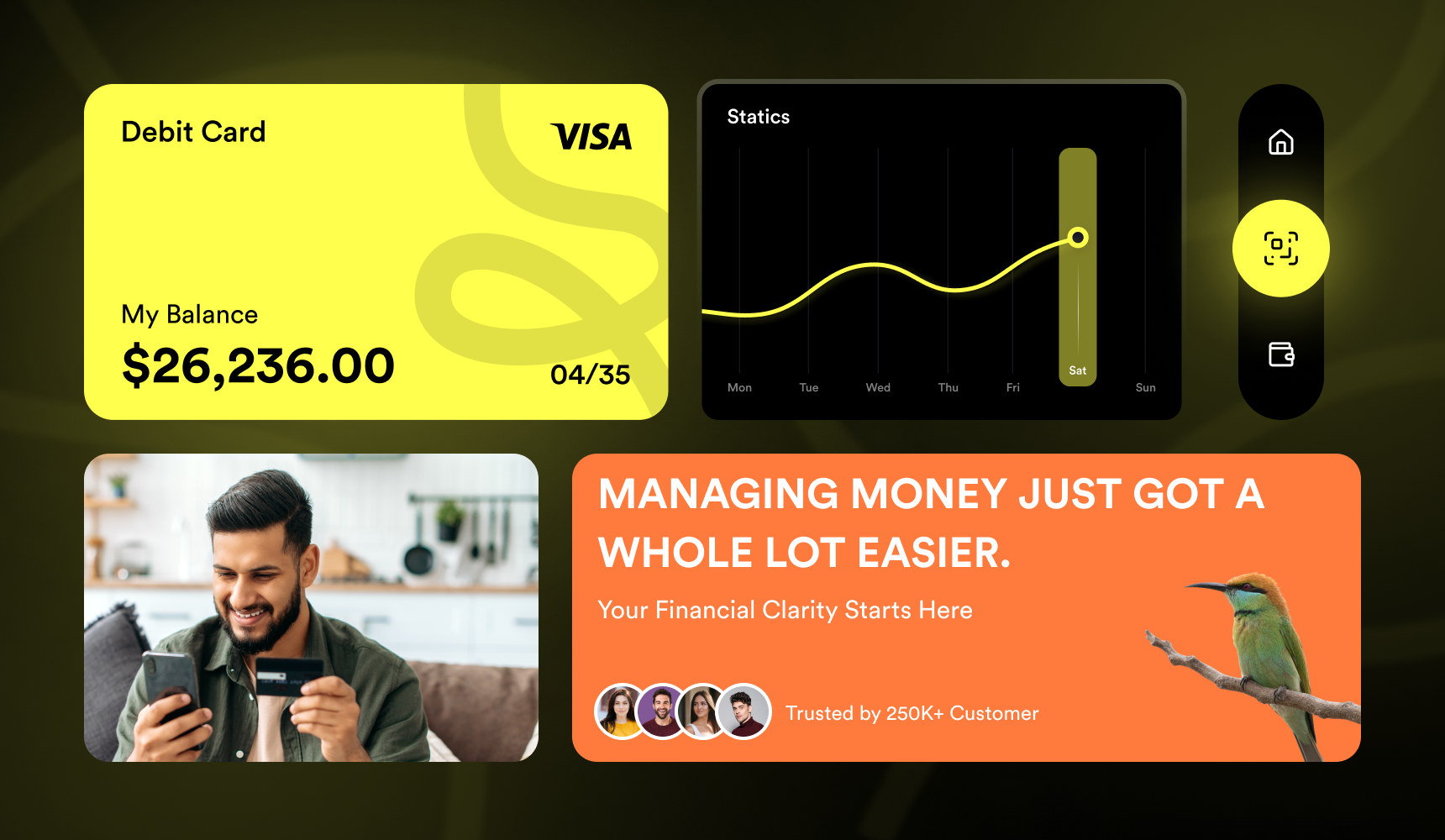

Unified Dashboard

Finovia consolidates all of their financial details, bank accounts, bills, savings, and goals, in one dashboard, providing users with an instant snapshot of their financial well-being.

Smart Automation

The app eliminates busy work by automatically categorising transactions, establishing budgets and prompting bill reminders so users can keep things on track in an easy and timely manner.

User-Friendly Design

From design to interaction, clarity is the point. Whether economically conscious or new to investing, users are easily guided and assured.

Insights & Tips

Encrypted API bank syncing in real time guarantees accuracy and security, and smart insights offer users the power to make the best financial decisions, at every moment, of every step.

Our Solution Provided the Following Advantages to Finovia and Its Users

Enhanced Financial Control

Now, users had a single, easy-to-understand view of their finances, relieving mental stress and enabling smart usage plans, smart spending tracking, and smart savings expectations.

Higher User Engagement

Intuitive dashboards and personalised insights meant the app kept users engaged in their financial management day to day.

Operational Efficiency

The ability to categorise, budget reminders, and data syncing helped decrease manual work, by increasing accuracy and reducing time spent in product by users and backend operations.

Boost in Retention & Trust

Seamless, safe, and user-friendly experience inspired users to choose Finovia as the ultimate financial tool, creating long-lasting trust and loyalty.

30%Boost in User Engagement

53%Increase in Orders

95%Increase in User Satisfaction

65%Boost in Revenue Streaming

Our Process to Build Finovia, A User-First Digital Finance Solution

01.Discovery & Research

- Industry & Trend Analysis

- Competitor Benchmarking

- Target Audience Profiling

- User Journey Workshops

- Goal Alignment & Scope Definition

02.Design & Prototyping

- Feature Prioritisation

- Experience Flow Mapping

- Wireframe Concepts

- Tech Stack Evaluation

- Project Timeline Setup

03.UI/UX Architecture

- Visual Identity & Branding

- Interactive Wireframes

- High-Fidelity UI Screens

- Usability Testing

- Cross-Platform Mockups

04.Agile Development

- Scalable Frontend Development

- Secure Backend Architecture

- Real-time API Integrations

- Cloud-Based Database Setup

- Agile Sprints & Iterations

05.Testing & Launch

- End-to-End QA

- Security & Compliance Checks

- App Store Submission

- Performance Optimisation

- Ongoing Support & Updates