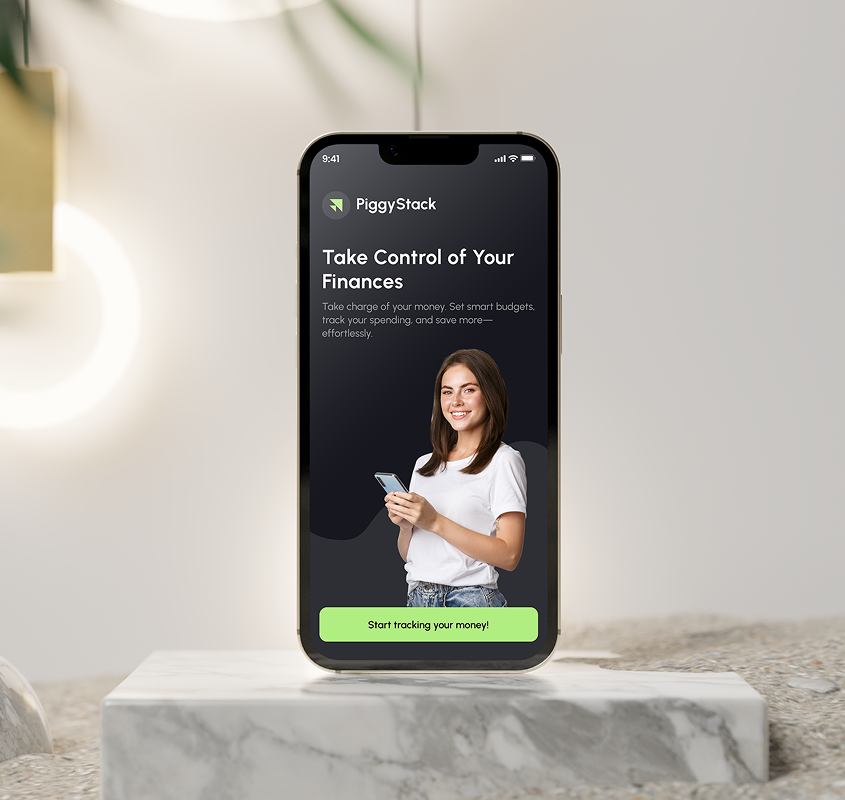

Helping Everyday Users Take Back Control of Their Finances, With Transparency, Ease, and Confidence

Those days are gone when people to manage their personal finance needs had to juggle to and from between spreadsheets, or needed to stick to those outdated banking apps, or use too basic budgeting tools that were never in sync with multiple platforms to allow access and collaboration with user data. We have stepped in to build a solution that doesn’t just track money, it helps people actually understand and manage it. Our mission was to bring everything under one roof and make finance feel less like a chore and more like a conversation.

Fintech

The Challenges

Managing personal finances shouldn’t feel like solving a puzzle. But for most users, it does, and here’s why:

Scattered Data

Dispersed, unorganized and scattered data footprints are common when people switch frequently between bank apps, budgeting platforms, and old-school spreadsheets.

No Real-time Insights

You can’t make good money decisions if you’re always a few steps behind. Without live updates or visual overviews, users feel like they’re flying blind.

Manual Tracking

Manually entering every dollar in and out in a finance tracker system is tedious, vulnerable to errors, and time-consuming for the users at large.

Outdated Experience

While most finance apps cater to accountants and experts, the average everyday users iften struggle with the complex user experience of a handful of apps.

The Solutions

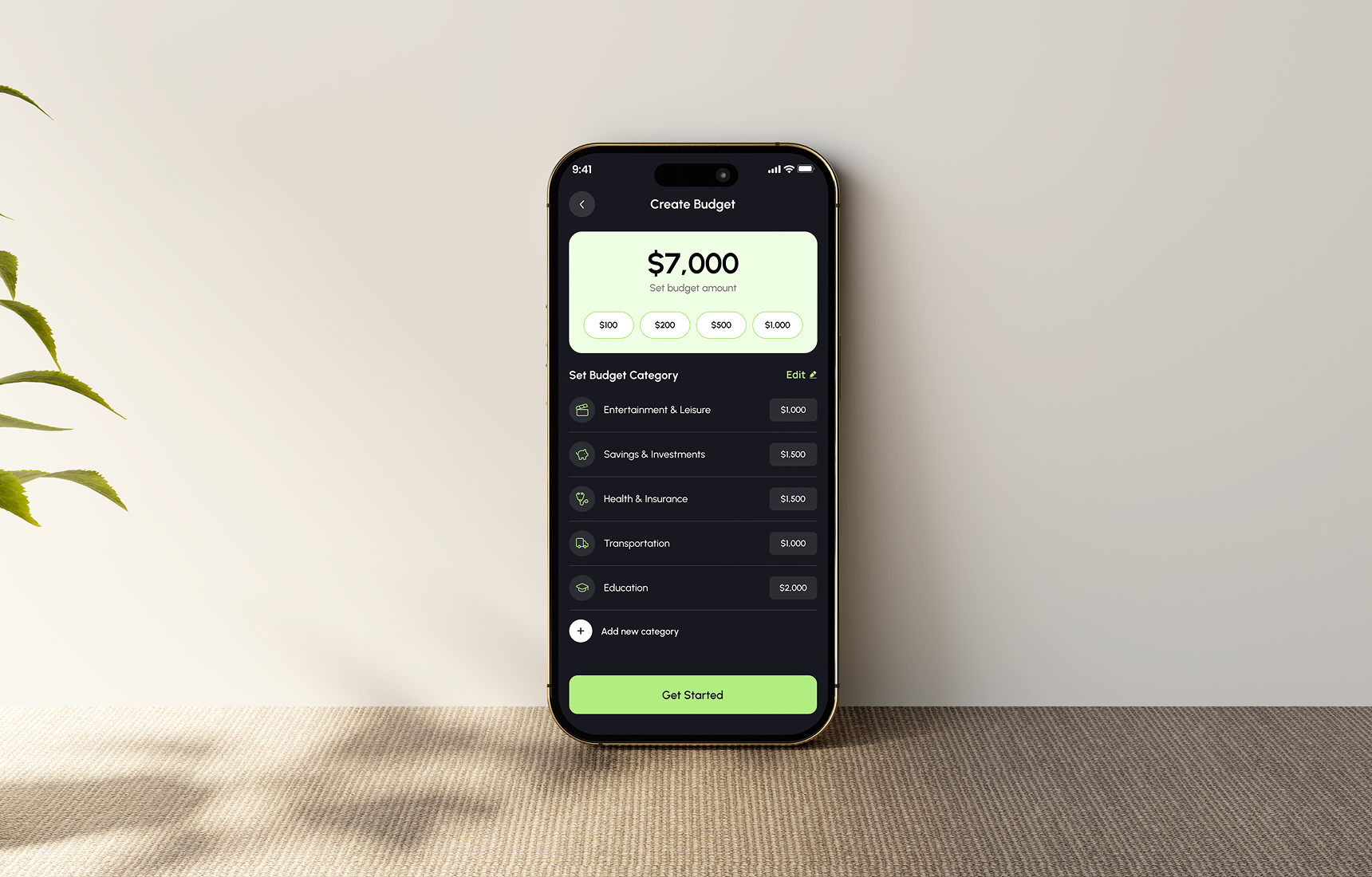

To make money management easier, smarter, and a little less painful, we built a finance app that delivers:

Unified Dashboard

One place for everything, checking accounts, savings, expenses, goals. It’s like a financial command center that actually makes sense.

Smart Automation

To streamline the tracking and financial data management, the app leveraged automatic categorization if transactions, budget management with few inputs and automated reminders for bills and invoices.

User-Friendly Design

Clean layouts, simple actions, and zero financial jargon. We designed it for real people, not just finance pros, so everyone can feel in charge of their money.

Insights & Tips

From syncing with banks in real-time to offering smart nudges and money-saving tips, the app becomes more than a tracker, it’s like having a financial sidekick.

Making A Turnaround in Personal Finance: What Our Solution Unlocked for Users

Customer Satisfaction

Users loved being able to manage everything from one clean dashboard. No more hopping between five different apps.

Increased Engagement

People actually came back daily, to check budgets, track spending, or just feel good seeing progress.

Streamlined Operations

Smart automation made user journey effortless as they do not need to struggle with same data inputs for multiple times.

Revenue Boost

With better user retention and upgraded features, subscription plans saw a solid lift. Users were happy to pay for something that worked.

30%Boost in user engagement

53%Increase in active subscriptions

95%Jump in user satisfaction

65%Rise in monthly recurring revenue

How We Brought PiggyStack to Life, Step by Step

01.Research & Strategy

- Market Research

- Competitor Analysis

- User Personas

- Journey Mapping

- Information Architecture

02.Ideation & Planning

- Site Mapping

- Moodboards

- User Stories

- Pain Point Discovery

03.Design Execution

- Branding

- Wireframes

- High-Fidelity Mockups

- Clickable Prototypes

04.Development

- Frontend Engineering

- Backend API Setup

- Database Architecture

05.Quality & Launch

- Functionality + Usability Testing

- Security Checks

- App Store Publishing

- Feedback Collection

- Ongoing Maintenance & Updates